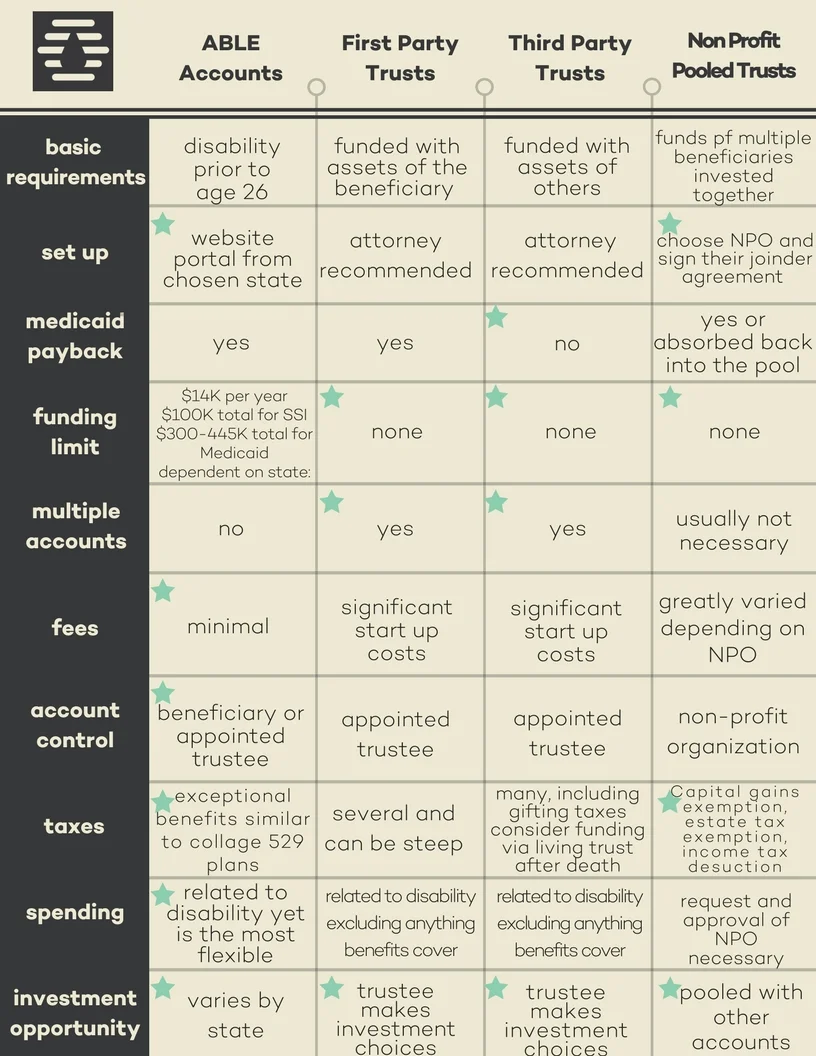

ABLE Account & Special Needs Trust Comparison

Able accounts are new on the scene and exist for the same reason as Special Needs Trusts.

Both are a way to help an individual with disabilities maintain eligibility of benefits. Before jumping into ABLE accounts, let’s review a few things from our Special Needs Trusts article.

First, the lingo

Beneficiary - the special needs individual

Trustee - the person in charge of overseeing the trust (scroll down for more)

Assets - anything of value

Fund - putting assets into the trust

Benefits - government programs such as Social Security and Medicaid

Medicaid payback - Using remaining funds in the trust after the death of the beneficiary to repay the government for a lifetime of Medicaid distributions

Second, the benefits thing

Assets over $2000 disqualify eligibility for benefits. The government may view assets differently than you. Take a look at this link for their perspective.

Using trusts and/or an ABLE account is incredibly important so your loved one can remain eligible for benefits while also having the money needed to cover expenses not covered by benefits. These are the places to hold assets needed to provide quality of life without being denied benefits due to exceeding the $2000 cap.

People are excited about ABLE accounts

Why? Because ABLE accounts offer incredible tax benefits. The disadvantages are funding caps and required Medicaid payback (see chart below). ABLE accounts operate very similarly to the 529 college savings plans (yay!) except only one ABLE account can be set up per person (bummer).

ABLE accounts are so new to the scene, not every state has an ABLE plan in place. Ohio was first out of the gates in 2016 (great job, Ohio!) and since then several states have jumped in and others are slated to follow.

The money section of Time.com is continually updating the list of states offering ABLE accounts.

Is your state on the list?

Whether it is or is not, doesn’t really matter too much because most state plans will let nonresidents open an account. However, there are a few which require residency, such as Florida. Oh well. They have Micky Mouse and great beaches, so we extend grace.

Each state has a different twist on their ABLE account such as minimum contributions, fees, investment options, tax incentives, etc. Use the time.com link above or this guide from the ABLE National Resource Center as a way to compare and contrast the state plan best for your situation.

If you need to utilize the ABLE account immediately, consider setting up an account in a state with a debit card system. This system is similar to how a checking account is used where a minimum amount (usually $2000) has to be in the account and payment can be made directly to the provider via a debit card. This prevents having to file for reimbursement and eases in record keeping. For an example of a state with this method, check out Virginia.

Let’s do a side by side comparison of ABLE accounts and the types of trusts we discussed last week.

Any questions? Yes? Okay, you in the front.

Oopsie! We made a deposit and now the account exceeds $100K! Will the beneficiary loose benefits?

Yes and No. Benefits will be suspended until the account ticks back down to below $100K

What if we are audited by the IRS?

Keep receipts whenever the ABLE account is used. An IRS audit will require this information.

Rent is higher than what benefits cover. Can we use our ABLE account and Special Needs Trust?

Trusts can not be used for housing (or anything else covered by benefits). On the other hand, ABLE accounts can be used for rent. Just make sure to pay the landlord directly and get a receipt for IRS records. The Dale Law Firm in California has this helpful video on their youtube channel covering housing and ABLE accounts.

My 37-year-old son has Down Syndrome. The qualifying age for an ABLE account is under 26. Are we out of luck?

Nope. As long as you have documentation of the diagnoses before the age of 26, your son is good to go.